hotel tax calculator nc

The british columbia annual tax calculator is updated for the 202223 tax year. 54 rows All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms.

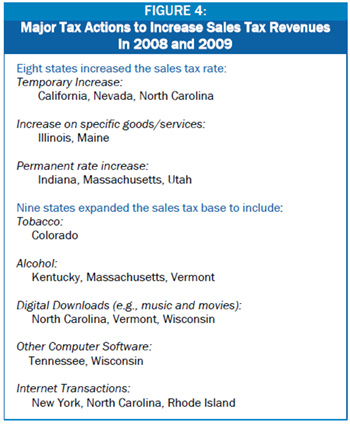

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

Just enter the wages tax withholdings and other information.

. How To Calculate Excise Tax In Nc. Usually the vendor collects the sales tax from the consumer as the consumer makes a. Your tax per night would be 1950.

State has no general. Have you ever wondered how to calculate the revenue stamps excise tax on the sale of real estate in North Carolina. C2 Select Your Filing Status.

The tax rate is 2. North carolina state sales tax. In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies.

Average Local State Sales Tax. North carolina has not always had a flat income tax rate though. Gross receipts derived from the rental of an accommodation and the sales and use tax thereon are to be reported to the Department on Form E-500.

North carolina state sales tax. Average Sales Tax With Local. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Lowest sales tax 675 Highest sales tax 75 North Carolina Sales Tax. The act went into full effect in 2014 but before then North Carolina had.

Our calculator has been specially developed in order. Maximum Possible Sales Tax. The average cumulative sales tax rate in the state of North Carolina is 694.

Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. North Carolina Gas Tax. North Carolina State Sales Tax.

Estimate Your Federal and North Carolina Taxes. North Carolina has a 475 statewide sales tax rate. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

C1 Select Tax Year. 4 Specific sales tax levied on accommodations. North carolina has not always had a flat income tax rate though.

Maximum Local Sales Tax. Hotel Tax Calculator AlbertaYou can also explore canadian federal tax brackets provincial tax brackets and canadas federal and provincial tax rates. This takes into account the rates on the state level county level city level and special level.

2022 List of North Carolina Local Sales Tax Rates. North Carolina Salary Tax Calculator for the Tax Year 202223 You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. Our calculator has been specially developed in order.

If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498. Provincial sales tax pst bulletin. This marginal tax rate.

This Thursday Friday the Buncombe County Tourism Development Authority TDA will host three public workshops as they begin crafting a 10-year strategic guide the. Your average tax rate is 1198 and your marginal tax rate is 22. The North Carolina Tax Calculator.

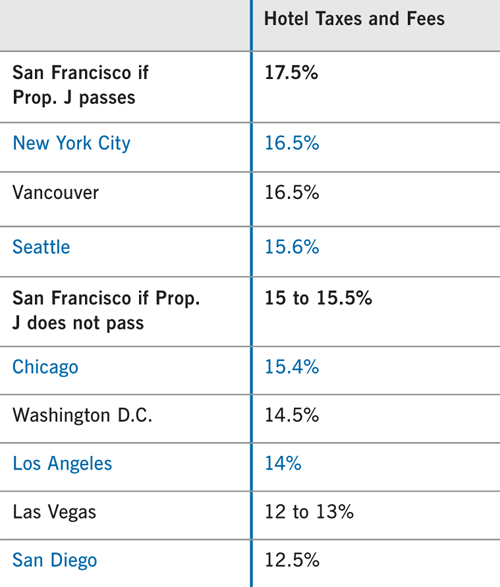

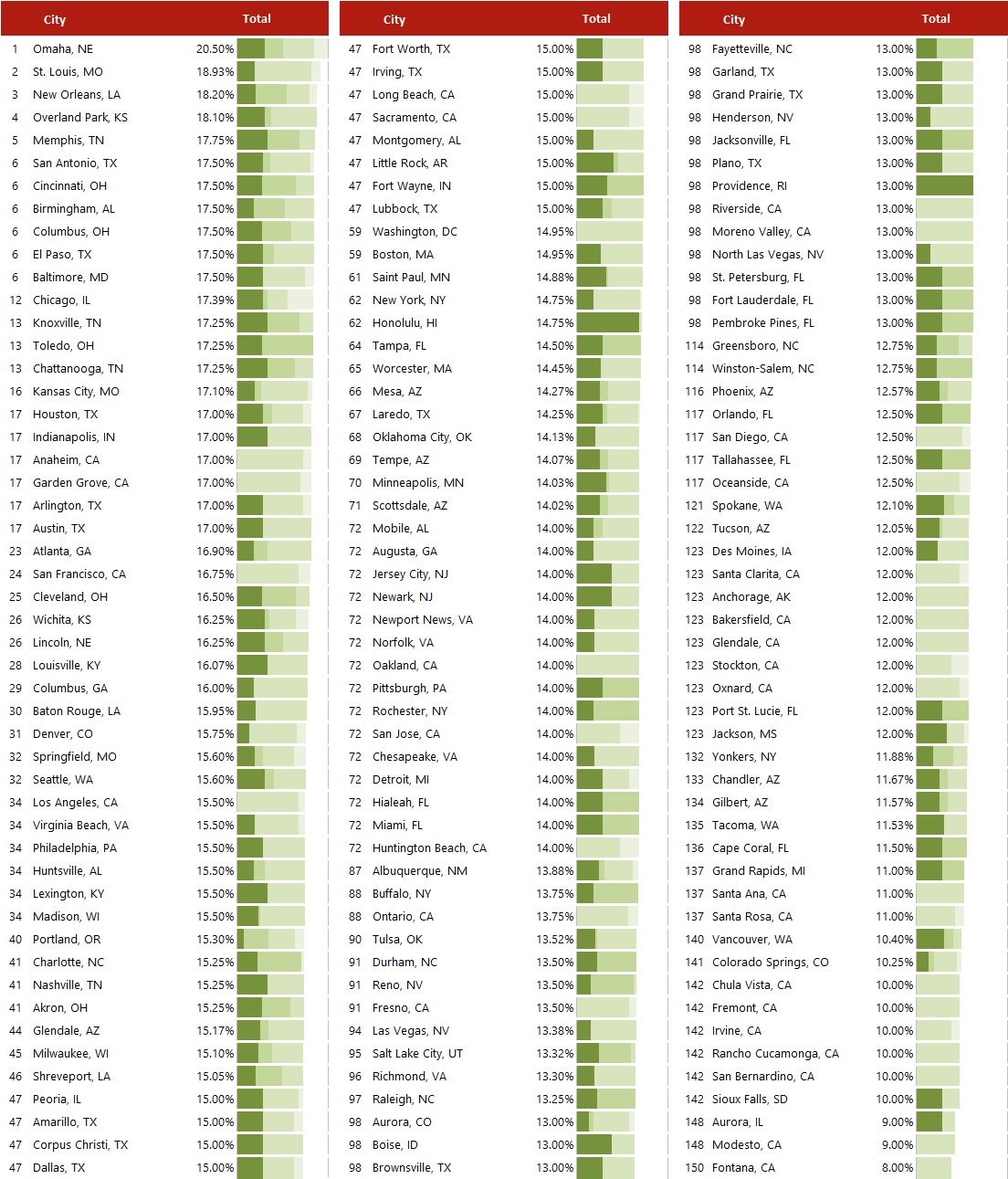

Occupancy Tax Rates For Airbnb In Major Cities Shared Economy Tax

Proposition J Hotel Tax Increase Spur

How Do State And Local Property Taxes Work Tax Policy Center

Sales Tax Calculator And Rate Lookup Tool Avalara

Annual State Local Tax Burden Ranking 2010 New York Citizens Pay The Most Alaska The Least Tax Foundation

States With The Highest Lowest Tax Rates

How High Are Spirits Taxes In Your State Tax Foundation

Texas Sales Tax Guide For Businesses

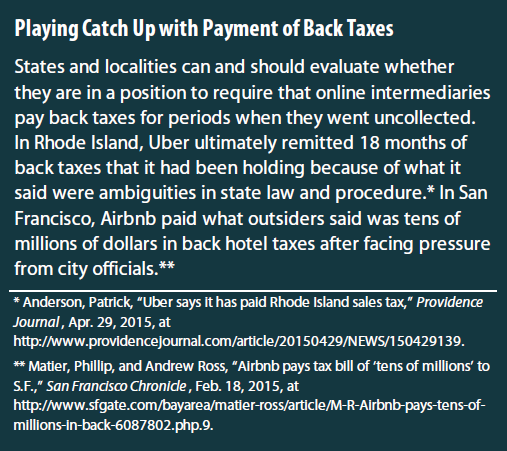

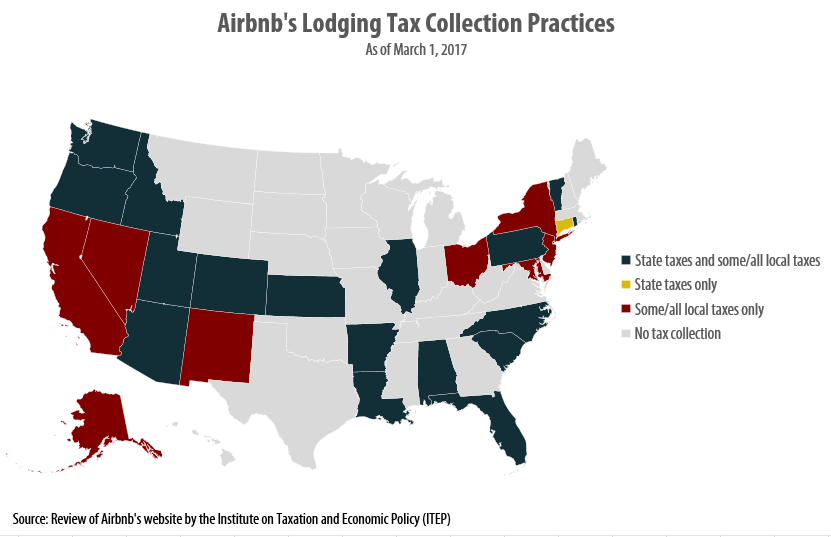

Taxes And The On Demand Economy Itep

Sales Taxes In The United States Wikiwand

Pennsylvania Sales Tax Guide For Businesses

Hvs 2020 Hvs Lodging Tax Report Usa

The San Diego County California Local Sales Tax Rate Is A Minimum Of 6 25

Sales Tax Calculator And Rate Lookup Tool Avalara

/cloudfront-us-east-1.images.arcpublishing.com/gray/Z2QYAQVPOZBPTFAGQJD6I6SFQM.jpg)

Nc Extends Tax Deadline To May 17

Understanding Hotel Taxes Resort Fees Deposits For Incidentals Your Mileage May Vary